In September 2025, the Indian equity markets, represented by benchmark indices Sensex and Nifty, experienced a largely sideways and muted performance, marked by heightened volatility, intermittent rallies, and persistent selling pressure. Despite early optimism in the month, both indices ended with flat to modest gains, largely shaped by a complex mix of domestic developments, global headwinds, sector-specific drags, and significant foreign institutional investor (FII) outflows. The overall tone of the market throughout the month was cautious and reactive, with participants navigating an environment filled with economic uncertainty, global policy shifts, and mixed corporate signals.

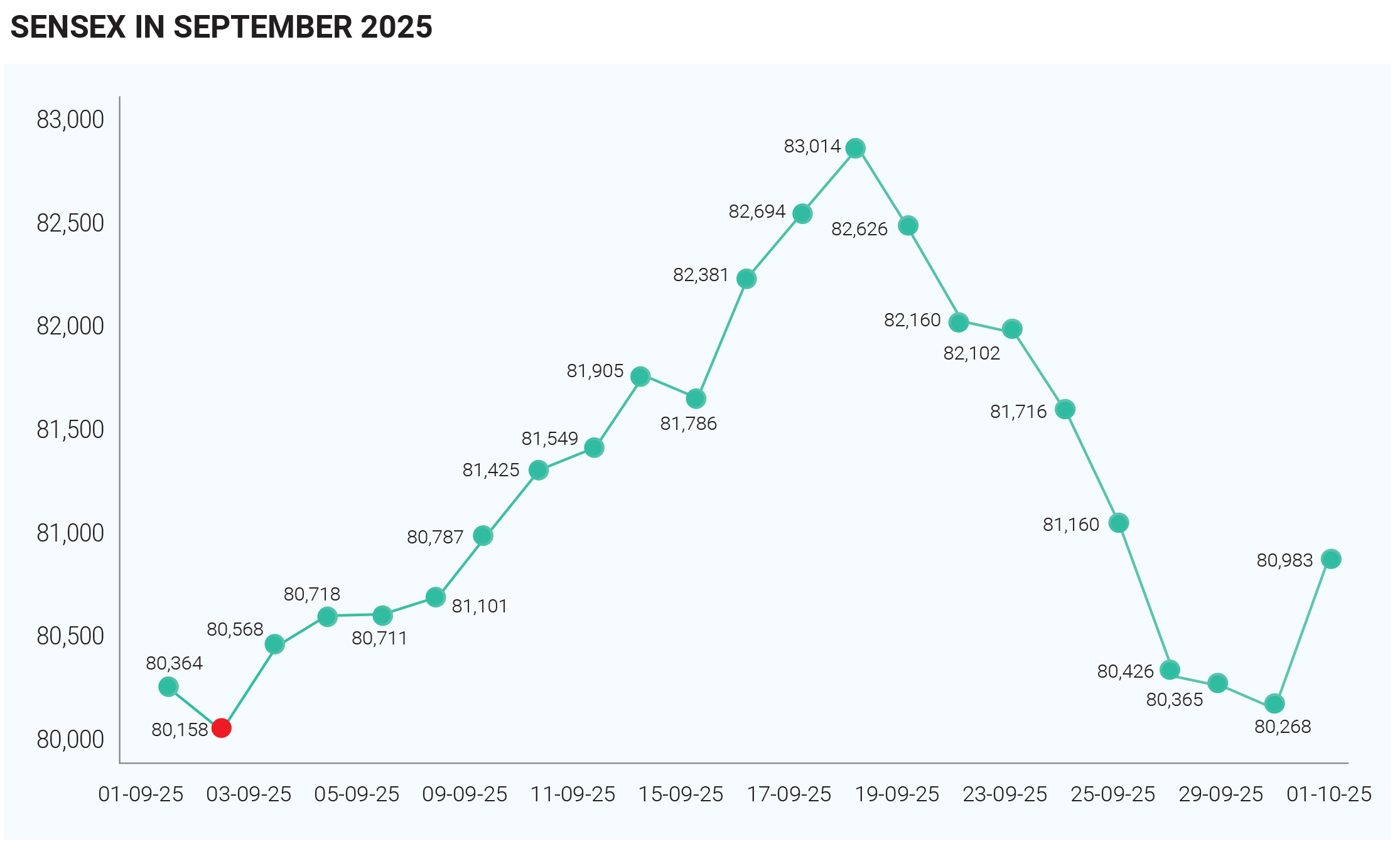

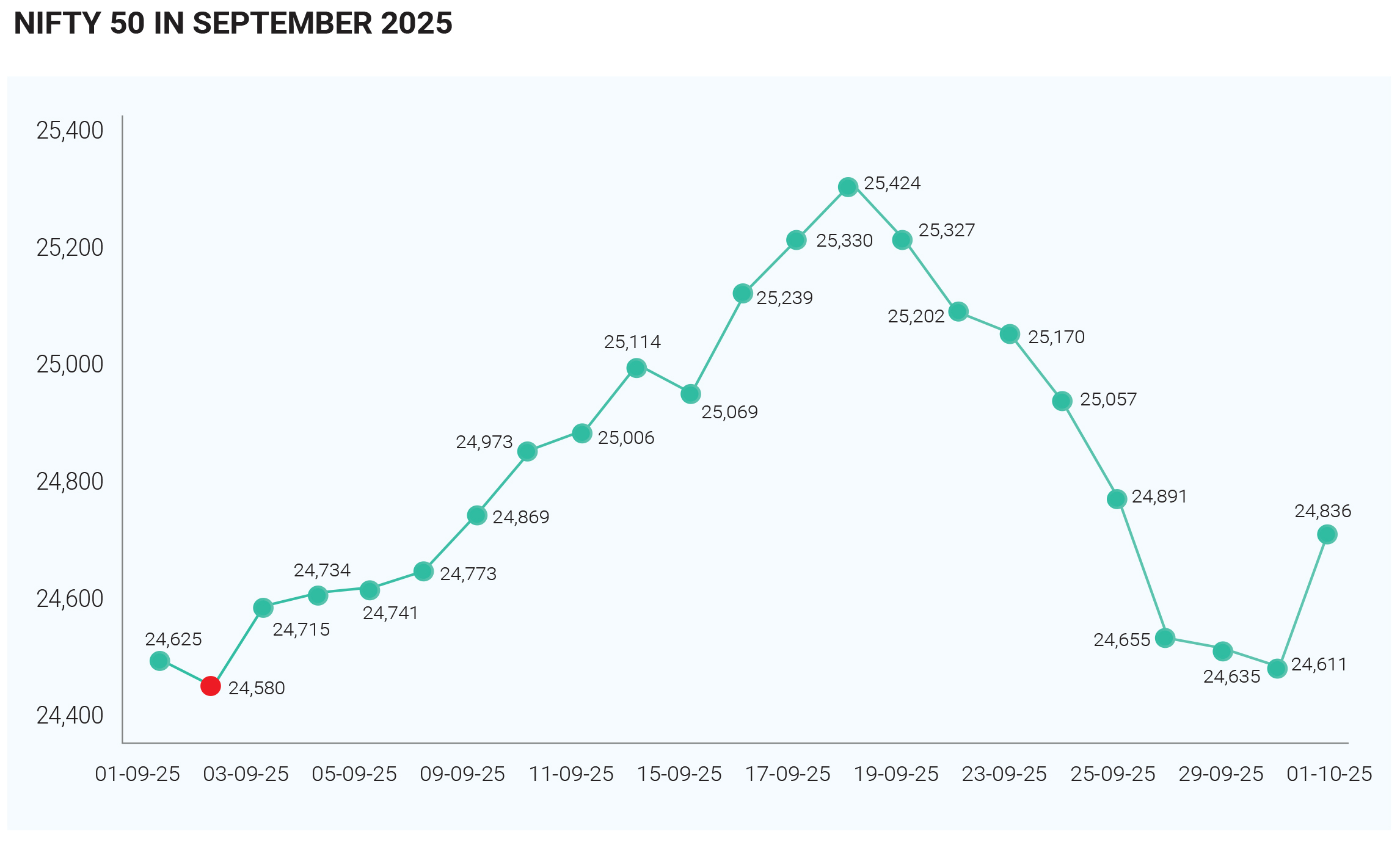

At the beginning of September, investor sentiment appeared upbeat. Both Sensex and Nifty climbed toward near-record highs, with the Sensex hovering between 80,300 and 81,900, while the Nifty traded between 24,700 and slightly above 25,100. This early rally was largely underpinned by optimism surrounding positive macroeconomic data, upbeat earnings expectations, and hopes of pro-growth policy reforms. However, this upward momentum failed to sustain itself as the month progressed, with the market losing steam in the latter half. Sectoral underperformance—particularly in IT, auto, and consumer-facing segments—combined with global uncertainty, led to a loss of gains and a shift in investor tone from bullish to defensive. By month-end, the Sensex and Nifty had posted monthly returns in the narrow range of 0.6% to 1.5%, highlighting the lack of decisive directional movement. Several factors contributed to this subdued performance. On the global front, ongoing trade tensions between the United States and India weighed heavily on sentiment. The imposition of 50% tariffs by the US on key Indian exports, including automobiles, textiles, and pharmaceuticals, sparked concerns over India’s export competitiveness and pressured related sectors. Simultaneously, continued uncertainty surrounding H-1B visa reforms in the US negatively impacted India’s IT sector—a long-time favourite among FIIs and a significant contributor to India’s services exports. The IT index fell sharply, registering a year-to-date decline of over 18% by the end of September, exacerbating selling pressure across the broader market. In addition, concerns about global economic health further fuelled caution. Investors were increasingly wary of a slowdown in the US and EU economies, sticky inflation, and the possibility of delayed interest rate cuts by the US Federal Reserve. These fears led to risk aversion among global investors, prompting them to exit emerging markets, including India. The Indian rupee also faced depreciation pressure, further eroding the appeal of Indian assets to foreign investors. As a result, FIIs were substantial net sellers in September, withdrawing between $2.5 billion and $2.7 billion (approximately ₹22,000 crore) from Indian equities, marking the third consecutive month of significant outflows. Domestically, the market narrative was shaped by a mix of positive structural reforms and ongoing macroeconomic concerns. One of the most significant developments was the announcement of GST rate cuts in late September. The government undertook long-awaited tax slab simplification, aimed at boosting consumption and improving ease of doing business. While the reform was welcomed from a long-term perspective, its short-term market impact was mixed. Uncertainty around the pace at which businesses would pass on these benefits to consumers limited the immediate positive reaction. Nonetheless, record GST collections for the month, touching ₹1.89 lakh crore, served as a testament to resilient domestic demand and strong compliance, offering some support to the markets amidst growing external pressures. On the economic front, the Asian Development Bank (ADB) revised India’s growth outlook upward to 6.5% for FY26–FY27, citing strong domestic fundamentals. This revision, coupled with robust manufacturing PMI data and steady credit growth in the banking sector, painted a relatively healthy picture of the domestic economy. Yet, this optimism was tempered by downward revisions in corporate earnings forecasts. Key sectors such as consumer durables, pharmaceuticals, and especially IT failed to meet analysts’ expectations, triggering profit booking and further dampening market sentiment. Defensive sectors like FMCG and PSU banks, which initially acted as safe havens, also saw selling pressure due to profit-taking and valuation concerns. The PSU banks and metals displayed relative resilience, supported by strong balance sheets, government capex, and continued demand from infrastructure and export markets. On the other hand, IT stocks bore the brunt of global policy and demand concerns. Consumer-facing sectors remained under pressure, weighed down by tepid festival-season demand and cautious investor positioning. Pharma stocks also struggled amid regulatory uncertainty in the US and weak margin guidance. However, midcaps and smallcaps saw selective investor interest, especially in financials, infrastructure-related plays, and new-age tech companies with domestic focus. Volatility throughout the month was driven not only by economic data but also by political and social developments. Early in the month, devastating floods in Punjab resulted in fatalities and widespread crop damage, contributing to concerns over food inflation and rural demand. Around the same time, reports of GST refund fraud and large-scale enforcement actions by tax authorities introduced an element of regulatory risk. Mid-September brought another inflationary data point, with retail inflation edging up slightly to 2.07% in August, raising fresh concerns about consumer purchasing power and demand recovery. The underlying theme for the Indian markets during September 2025 was the tug-of-war between structural domestic strength and persistent global fragility. On the one hand, India continued to benefit from strong tax collections, improving economic forecasts, and a supportive policy environment. On the other hand, markets were haunted by deteriorating global relations—particularly the US-India trade standoff—high FII withdrawals, and sectoral earnings disappointments. These opposing forces led to choppy trading patterns, with no clear breakout or breakdown across the major indices. To summarise September 2025 was a month of equilibrium for the Indian stock market—where the forces of growth optimism and policy reform clashed with the realities of global headwinds, earnings stress, and foreign investor retreat. Despite strong macroeconomic indicators like record GST collections and an improved GDP outlook, the market was unable to capitalize on these positives due to the drag from IT, consumption, and external volatility. FII outflows, amounting to nearly ₹22,000 crore in a single month, served as a critical headwind and one of the primary reasons for the lacklustre performance of Sensex and Nifty. Policy developments like GST rate cuts showed the government's intent to revive demand, but investors remained cautious about the short-term implications.

In September 2025, the Indian debt market displayed cautious resilience and relative stability, with investors navigating a complex landscape of domestic monetary policy signals, global uncertainties, and shifting capital flows. Government bond yields declined marginally during the month, supported by improved demand for safer assets amidst volatility in equity markets and concerns over the depreciating rupee. The 10-year benchmark government bond yield fluctuated within a tight band of 6.50% to 6.53%, ending slightly lower than the previous months. This minor drop reflected market expectations of potential monetary easing by the Reserve Bank of India (RBI) and a general preference for stability in fixed-income instruments during a time of heightened global uncertainty. Auctions for state development loans (SDLs) and government securities (G-Secs) saw robust demand, signalling growing investor interest in low-risk assets, especially as equity market performance remained volatile. Corporate bond markets also maintained healthy activity, driven by a continuation of record-high issuances in FY25 and FY26. Earlier interest rate cuts, combined with improved credit profiles of many corporates, fuelled investor confidence and facilitated funding through debt instruments. The steady performance in this segment was further supported by the RBI’s decision to maintain the repo rate at 5.50% in its September policy meeting. While the central bank refrained from altering rates, it indicated that inflation was largely under control and that there was scope to adopt a more pro-growth stance if required. This dovish tone buoyed expectations of a potential rate cut in December, keeping fixed-income sentiment positive and bond yields relatively subdued. Global economic conditions also played a significant role in shaping the mood of the Indian debt market. Mixed signals from the US economy, including persistent inflation concerns, a cautious approach by the US Federal Reserve regarding rate cuts, and lingering geopolitical tensions, kept global bond yields under upward pressure. Nevertheless, signs of easing trade tensions and softening economic data in major economies created room for positive sentiment to return to emerging markets like India. On the fiscal front, domestic developments had a mixed but manageable impact on bond markets. The Indian government’s announcement of GST rate cuts in September was a significant step toward boosting consumption and simplifying tax compliance. While such measures could be seen as a potential drag on near-term fiscal revenues, the overall market reaction remained calm. Investors viewed the reform positively from a long-term economic growth perspective. Moreover, strong GST collections for the month, totalling a record ₹1.89 lakh crore, alleviated concerns about fiscal slippage, supporting continued demand for government securities. Foreign Portfolio Investors (FPIs) played a nuanced role in the debt market during the month. While they remained aggressive net sellers in Indian equities—pulling out over $2 billion—they showed moderate interest in Indian debt instruments. Inflows from FPIs totalled approximately ₹900 crore under the general investment limit and another ₹1,100 crore via the voluntary retention route (VRR). These selective investments in government securities and high-quality corporate bonds reflected a cautious but positive outlook toward Indian fixed-income assets. However, the pace of inflows was slower than in previous months, largely due to the significant depreciation of the Indian rupee, which raised concerns over currency-adjusted returns. The rupee hit an all-time low near ₹88.80 per US dollar in late September, driven by a combination of factors including equity outflows, rising import demand, and geopolitical pressures. Several broader macroeconomic and global developments influenced capital flows and exchange rates during the month. The rupee’s depreciation was among the most significant financial stories of September 2025. Its fall to nearly ₹88.80 per USD reflected both external and internal pressures. Key among these were portfolio outflows from equities, the escalation of US-India trade tensions, a widening trade deficit, and a rise in gold imports ahead of the festive season. The US's decision to double tariffs on Indian exports and raise H-1B visa fees created additional headwinds for the IT and manufacturing sectors, further undermining investor sentiment and accelerating capital flight. In parallel, global financial market volatility, rising oil prices (Brent crude nearing $70 per barrel), and geopolitical tensions—especially surrounding the Russia-Ukraine conflict and Iran—drove increased demand for the US dollar, putting pressure on emerging market currencies like the rupee. Despite this, the RBI chose not to intervene aggressively in the forex market, allowing for a controlled depreciation while maintaining liquidity support in the domestic system. Its intervention strategy aimed to avoid disorderly currency movements without burning through foreign exchange reserves. While the weakening rupee did raise concerns among FPIs, India’s macroeconomic fundamentals—strong tax revenues, manageable inflation, and a stable interest rate environment—kept investor faith intact in the debt market, even as global uncertainty prompted a “wait and watch” approach. In conclusion, the Indian debt market in September 2025 remained a zone of cautious optimism. It was underpinned by a supportive monetary policy, stable demand for long- and short-duration instruments, selective FPI inflows, and robust domestic liquidity. Looking ahead, investor focus will remain on RBI's December policy decision, the trajectory of inflation, and developments in global trade and geopolitical risk—all of which will influence the direction of yields, capital flows, and the overall momentum of the debt market in the final quarter of the year.

In September 2025, the Indian rupee witnessed a notable phase of depreciation, slipping close to its all-time low of around ₹88.80 per US dollar. The downward movement of the currency was shaped by a confluence of domestic and global developments that heightened investor uncertainty and intensified dollar demand. The depreciation underscored the vulnerability of emerging market currencies, including the rupee, to global monetary shifts, trade tensions, and capital flow reversals. One of the foremost drivers of the rupee’s decline was the heavy portfolio outflows by foreign institutional investors (FIIs). In the latter part of September alone, FIIs withdrew nearly $2 billion from Indian equities, largely due to concerns over weakening global risk appetite and heightened uncertainty surrounding U.S.-India trade relations. The sell-off in Indian equities and debt markets was further exacerbated by profit-booking tendencies and a flight to safer assets like U.S. Treasury bonds amid global volatility. The escalation in U.S.-India trade tensions was another key factor influencing the rupee’s slide. The U.S. government’s decision to raise tariffs on Indian exports—from 25% to 50%—significantly dented India’s export competitiveness and investor sentiment. Additionally, the sharp increase in H-1B visa fees created further strain on bilateral relations, particularly affecting India’s information technology and services sectors that rely heavily on U.S. contracts and workforce placements. These developments led to reduced confidence among global investors and encouraged further capital withdrawals, amplifying the pressure on the currency. Domestically, India’s widening trade deficit added structural weakness to the rupee. Although exports showed moderate growth in select categories, high gold imports ahead of the festive season, along with elevated crude oil prices, inflated the import bill. Brent crude prices climbed back toward $70 per barrel during the month, driven by geopolitical conflicts and production cuts. The increase in oil prices directly impacted India’s current account deficit, as the country imports more than 80% of its crude oil requirements. The combined impact of higher import costs and persistent demand for U.S. dollars to settle trade payments aggravated the depreciation pressure on the rupee. Global financial market volatility also played a significant role. Investor sentiment toward emerging markets weakened amid rising geopolitical tensions—particularly those related to the Russia-Ukraine conflict and renewed uncertainty around Iran’s nuclear negotiations. Heightened global security concerns and uneven economic recoveries led investors to rebalance their portfolios toward developed markets, strengthening the U.S. dollar’s relative demand. Although the U.S. Dollar Index (DXY) fell by around 6.6% against major currencies, the rupee depreciated more sharply, indicating that domestic challenges had a more pronounced effect than global currency movements. The Reserve Bank of India (RBI) maintained a vigilant stance throughout the month, intervening selectively to prevent disorderly fluctuations in the foreign exchange market. The central bank’s strategy reflected a delicate balance between allowing market-driven depreciation to preserve external competitiveness and ensuring financial stability by curbing speculative volatility. Despite short-term weakness, the RBI emphasized that India’s macroeconomic fundamentals—such as strong foreign exchange reserves, moderate inflation, and steady growth momentum—remained resilient. Overall, the rupee’s depreciation in September 2025 was the result of a complex interplay between domestic structural pressures and adverse global economic conditions. Trade imbalances, capital outflows, and geopolitical uncertainties converged to create sustained pressure on the currency. However, India’s underlying economic strength and policy stability continued to offer a buffer against excessive volatility.

In September 2025, crude oil prices, particularly Brent crude, exhibited a generally downward trend, although the market experienced notable volatility driven by a complex interplay of geopolitical developments and supply-side dynamics. Throughout the month, Brent crude fluctuated within a range of $64 to $70 per barrel, ultimately closing at approximately $67.02 on September 30. This represented a decline of around 4% for the month, driven primarily by growing concerns about a potential oversupply in the global oil market, which outweighed short-term price spikes caused by geopolitical risks. One of the central factors putting downward pressure on oil prices was the decision by OPEC+ to significantly increase production levels. The alliance, which had previously implemented voluntary cuts to stabilize prices, announced a major expansion of output for October and November, including a tripling of production hikes planned for November. This supply-driven pressure was further amplified by increased output from non-OPEC producers and the adaptation of sanctioned countries like Russia, whose crude exports in September reached a 16-month high, signalling a strong recovery in global oil supply. Despite these supply increases, several geopolitical flashpoints kept oil markets on edge. The escalating conflict in Gaza and continued instability in the Middle East introduced short-term fears of potential supply disruptions. Similarly, Ukraine’s drone attacks on Russian oil refineries raised concerns about short-term refinery shutdowns. Another critical factor influencing oil markets in September was the rising level of US crude and gasoline inventories. Seasonal declines in refinery activity and weakening demand led to inventory build-ups, reinforcing concerns about a potential imbalance between supply and demand. Furthermore, uncertainty surrounding the US economy—particularly fears of a potential government shutdown—added a layer of demand-side pessimism. With investors wary of how a political standoff might impact economic activity and energy consumption, this uncertainty further suppressed oil prices. Additionally, Iran remained in focus due to renewed US sanctions and ongoing ambiguity regarding its nuclear deal. While concerns over reduced Iranian oil exports briefly supported prices, the overall market consensus leaned toward bearishness as supply increases elsewhere appeared more than sufficient to offset any losses from Iran. The unwinding of OPEC+’s voluntary cuts also highlighted the group’s strategic shift from price defence to market share protection, particularly in response to rising output from US shale and other non-OPEC producers. Broader global uncertainties—ranging from macroeconomic risks to unresolved geopolitical conflicts—also played a role in market volatility. However, they failed to provide lasting support to prices given the overwhelming narrative of increasing global supply. In summary, September 2025 was a month where supply-side developments, particularly OPEC+ production increases and rising inventories, took precedence over geopolitical concerns, resulting in a general downward trend in oil prices despite occasional rebounds caused by conflict-driven fears.

In September 2025, bullion markets experienced a remarkable surge as both gold and silver prices climbed to record highs in India, driven by a combination of festive demand, currency depreciation, and strong global cues. Gold prices rose sharply by more than ₹1,400 during the month, with 24-carat gold reaching around ₹1,18,310 per 10 grams in Mumbai by the end of September. Silver followed a similar trajectory, touching an unprecedented ₹1,51,000 per kilogram in major Indian cities. The rally reflected a perfect storm of domestic seasonal buying, global safe-haven demand, and macroeconomic shifts that strengthened investor interest in precious metals. A key factor behind this surge was the onset of the festive season. With Diwali approaching in October, Indian households, traders, and jewellers engaged in substantial buying to meet both cultural and commercial needs. This seasonal demand created strong momentum in the domestic bullion market, amplifying price increases that were already supported by international trends. Jewellers across India replenished their inventories, anticipating a surge in retail sales, which further tightened supply and elevated prices. Global uncertainties also played a decisive role in shaping bullion movements. The persistence of geopolitical tensions—particularly the US-India trade disputes, escalating Middle East conflicts, and uncertainties surrounding the Russia-Ukraine situation—led investors to seek safety in tangible assets like gold and silver. Precious metals traditionally serve as a refuge during periods of economic or political instability, and in 2025, this sentiment was especially pronounced. As global markets exhibited volatility and equity indices fluctuated, institutional and retail investors alike turned toward bullion as a hedge against risk. Adding to the domestic price momentum was the depreciation of the Indian rupee, which traded close to its all-time low of ₹88.80 per US dollar during September. Since India imports nearly all its gold and silver, the weaker rupee made imports more expensive, directly translating into higher local bullion prices. Despite elevated prices, imports nearly doubled during the month as banks and jewellers aggressively stocked up in anticipation of festive season sales. This proactive import activity supported short-term price firmness, as domestic inventories adjusted to meet the growing consumer appetite. Global monetary expectations further bolstered bullion markets. Investors increasingly anticipated rate cuts by major central banks, especially the US Federal Reserve, in response to slowing global growth and inflation concerns. Lower interest rates generally make non-yielding assets like gold more attractive, as the opportunity cost of holding them declines. Additionally, exchange-traded funds (ETFs) and central bank purchases became major demand drivers. Gold-backed ETFs witnessed robust inflows from both institutional and retail investors, providing sustained upward momentum. Analysts estimated that ETF demand in 2025 was roughly 50% stronger than in previous years, underscoring the scale of financial investment interest in gold as a defensive asset. At the same time, central banks—particularly from emerging economies such as India, China, and Turkey—continued an unprecedented gold-buying spree, diversifying their reserves away from the US dollar. This institutional accumulation was largely insensitive to short-term price fluctuations, creating a strong foundation that underpinned the global rally. The combined effect of strategic central bank purchases and ETF inflows pushed international gold prices toward $3,800–$4,000 per ounce, marking one of the strongest sustained rallies in recent years. Overall, the surge in bullion prices in September 2025 reflected the convergence of powerful global and domestic forces. Festive season demand, rupee depreciation, safe-haven buying, and structural central bank accumulation together propelled gold and silver to historic highs.

September 2025 marked a defining period for the global cryptocurrency landscape, characterized by accelerating regulatory clarity, deepening institutional adoption, and expanding blockchain innovation—even as most digital assets, apart from Bitcoin, experienced cooling prices after earlier rallies. Bitcoin defied historical trends by maintaining relative stability with a modest 5% gain, a sharp contrast to the typical bearish behaviour observed in September, when it has averaged a 3.7% decline since 2013. This resilience reflected a fundamental shift in the market narrative—from speculative, retail-driven trading to sustainable, regulation-backed growth and institutional participation. For over a decade, September has carried a reputation for weakness in crypto markets, but 2025 proved different. The passage of the Digital Asset Market Clarity Act (CLARITY Act) in the U.S. House of Representatives—awaiting Senate approval—marked a turning point in the regulatory evolution of digital assets. The legislation categorized cryptocurrencies into three distinct groups: commodities, securities, and stablecoins. This framework effectively ended the long-standing jurisdictional conflict between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), bringing long-sought legal certainty to the market. The result was a surge in stablecoin custody solutions, cross-border blockchain settlement systems, and growing institutional confidence in treating Bitcoin as a legitimate portfolio allocation within diversified investment strategies. The GENIUS Act, signed into law in July 2025, complemented this progress by establishing nationwide standards for stablecoin transparency, collateralization, and reporting. Together, these reforms signalled the U.S. government’s shift away from “regulation by enforcement” toward a cooperative model that fosters innovation while safeguarding investors. The SEC and CFTC jointly introduced new frameworks allowing national exchanges to list and trade spot crypto products and launched consultations to modernize rules on custody, margin, and derivatives. Collectively, these efforts positioned the U.S. as a global regulatory leader, setting the tone for responsible digital asset integration into mainstream finance. Institutional adoption reflected this newfound confidence. Exchange-Traded Funds (ETFs) became a central channel for regulated exposure to crypto markets. In 2025 alone, ETF inflows reached a record $29.4 billion, with BlackRock’s IBIT leading the surge. ETFs now account for nearly one-quarter of global Bitcoin trading volume, acting as liquidity anchors that dampen volatility and reduce dependence on speculative retail flows. This structural stability further legitimized Bitcoin as a strategic asset class and paved the way for broader institutional participation in digital finance. Beyond regulation and ETFs, innovation across blockchain ecosystems remained vibrant. Perpetual decentralized exchanges (Perp DEXs) such as Aster and Hyperliquid posted record trading volumes, generating nearly one-third of blockchain fee revenue for the month. Meanwhile, tokenization of real-world assets (RWAs)—including real estate, commodities, and bonds—gained traction on platforms like Avalanche, Hedera, and Stellar, underscoring blockchain’s shift from speculative experimentation to tangible enterprise applications. Even within a cooling market, the presale success of BullZilla ($BZIL), a meme coin, highlighted the continued social and community-driven enthusiasm that defines crypto culture. Overall, September 2025 was more than a month of regulatory milestones—it represented the maturation of the digital asset ecosystem. The developments of the month firmly positioned digital assets as an evolving pillar of the modern financial system, signalling a new era where blockchain and crypto coexist seamlessly with traditional finance. Complete list of NFOs (New Fund Offers) and IPOs (Initial Public Offerings) launched in India during September and October 2025

Copyright © 2021 Fintso